HELLO MEDISYS

Welcome aboard!

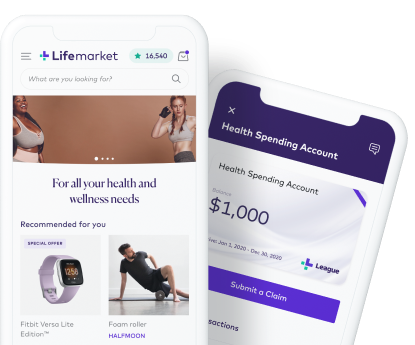

Start your health journey with League. Our mission is to empower you to live a healthier, happier life. Our easy-to-use app brings together everything you need to manage your health benefits and reach your personal health milestones—all from your phone.

GET TO KNOW US

We’re here to make your life easier (and healthier).

Health Concierge

Talk to a member of our team of registered nurses to address any health concerns of you or your family.

Health Programs

Based on your health profile, receive recommended programs with daily tasks that inspire healthy choices.

Digital Wallet

All your benefits coverage info, all in one place. Access benefits cards and submit lifestyle spending account claims.

Marketplace

A curated Marketplace with exclusive offers and discounts on products and services that support your wellbeing.

MY PLANS

Let’s take a look at your plan options.

We are pleased to introduce League and some exciting new features this year! At Medisys, we understand that one size never fits all. For that reason, we’ve outlined options for health & dental with varying levels of coverage and flexibility. We want to be able to support the needs of our members (that’s you!) and your loved ones.

Core

A great plan with tons of flexibility. Make sure you’re aware that this plan doesn’t include vision coverage, but excess credits can be used towards your spending accounts for some extra cushioning.

Desjardins

Enhanced

A more comprehensive plan for those who may have frequent medical appointments or a pre-existing condition. This plan has the highest monthly cost but you get the highest level of coverage.

Desjardins

Dispensing fee cap of $11 per prescription

Coinsurance: 80% up to the RAMQ annual maximum out-of-pocket amount per certificate, per calendar year, and 100% thereafter

Dispensing fee cap of $11 per prescription

Coinsurance: 80% up to the RAMQ annual maximum out-of-pocket amount per certificate, per calendar year, and 100% thereafter

Eye Exams: 1 exam every 24 months (adults); 1 exam every 12 months (children)

80%; Combined maximum of $500 per benefit year

80%; Combined maximum of $1,000 per benefit year

80%; Combined maximum of $300 per benefit year

80%; Combined maximum of $750 per benefit year (including a separate maximum of $500 per benefit year for massage therapist)

Orthotics & arch supports: Not covered

Orthopaedic shoes: Not covered

Hearing Aids: Not covered

Orthotics & arch supports: 80%; One pair up to $300 per 12 months

Orthopaedic shoes: 80%; One pair up to $300 per benefit year

Hearing Aids: 80%; $500 per 60 months

Lifetime maximum payable amount of $5,000,000/insured person. Coverage during the first 60 days of a stay outside your province of residence

Basic: 80%

Endo & Perio: 80%

Basic: 90%

Endo & Perio: 80%

Core

A great plan with tons of flexibility. Make sure you’re aware that this plan doesn’t include vision coverage, but excess credits can be used towards your spending accounts for some extra cushioning.

Plan Details-

Drugs

Deductible: $10 per prescription

Dispensing fee cap of $11 per prescription

Coinsurance: 80% up to the RAMQ annual maximum out-of-pocket amount per certificate, per calendar year, and 100% thereafter - Vision Not Covered

- Hospital 80% semi-private room

-

Mental Health

Psychologist, social worker, registered clinical counsellor, psychotherapist and marital/couple/family therapist

80%; Combined maximum of $500 per benefit year - Massage Therapy Not covered

-

Paramedical

Physiotherapist, physical rehabilitation therapist and sports therapist

80%; Combined maximum of $300 per benefit year -

Medical Services and Supplies

Private Nursing Care: 80%; $5,000 per 12 months

Orthotics & arch supports: Not covered

Orthopaedic shoes: Not covered

Hearing Aids: Not covered -

Travel

100%

Lifetime maximum payable amount of $5,000,000/insured person. Coverage during the first 60 days of a stay outside your province of residence - Dental Your dental plan options are separate from your Extended Heath Care plan above, you can select one of the two dental plans below or opt out.

-

Preventative & Basic Services

Preventative: 80%

Basic: 80%

Endo & Perio: 80% - Major restorative services 50%

- Maximums Preventative & Basic Services and Major restorative: combined maximum of $1,500 per benefit year

- Orthodontics Not Covered

Enhanced

A more comprehensive plan for those who may have frequent medical appointments or a pre-existing condition. This plan has the highest monthly cost but you get the highest level of coverage.

Plan Details-

Drugs

Deductible: $5 per prescription

Dispensing fee cap of $11 per prescription

Coinsurance: 80% up to the RAMQ annual maximum out-of-pocket amount per certificate, per calendar year, and 100% thereafter -

Vision

80%; $250 every 24 months

Eye Exams: 1 exam every 24 months (adults); 1 exam every 12 months (children) - Hospital 80% private room

-

Mental Health

Psychologist, social worker, registered clinical counsellor, psychotherapist and marital/couple/family therapist

80%; Combined maximum of $1,000 per benefit year - Massage Therapy 80%; Separate maximum of $500 per benefit year for massage therapist

-

Paramedical

Physiotherapist, physical rehabilitation therapist, sports therapist, acupuncturist, audiologist, chiropractor, dietician, massage therapist, naturopath, occupational therapist, osteopath, podiatrist and speech therapist

80%; Combined maximum of $750 per benefit year (including a separate maximum of $500 per benefit year for massage therapist) -

Medical Services and Supplies

Private Nursing Care: 80%; $10,000 per 12 months

Orthotics & arch supports: 80%; One pair up to $300 per 12 months

Orthopaedic shoes: 80%; One pair up to $300 per benefit year

Hearing Aids: 80%; $500 per 60 months - Travel

-

Preventative & Basic Services

Preventative: 90%

Basic: 90%

Endo & Perio: 80% - Major restorative services 50%

- Maximums Preventative & Basic Services and Major restorative: combined maximum of $2,500 per benefit year

- Orthodontics 50% for children under age 19 $2,000 lifetime maximum

Also included with your benefits:

- Short and Long-Term Disability

- Life Insurance and Accidental Death & Dismemberment (AD&D)

- Optional Critical Illness, Optional Life & Spousal Optional Life and Optional AD&D

- Employee Assistance Program (EAP)

Too much lingo? We want to make it easier for you.

HOW TO ENROLL

What’s next?

Once you’ve looked over your plan options and found the perfect fit, you can enroll with League and make your plan elections.

STEP 1

Check your email

Find your League invite in your inbox.

STEP 2

Create an account (if you haven't already)

Follow the instructions and the link in our email (then you’re in!).

STEP 3

Select your plan

Follow our step-by-step instructions to make your plan elections.

IMPORTANT DATES TO REMEMBER

Open enrollment period Mar 04-13

March 4-13, 2020

Open Enrollment Period

April 1, 2020

Benefits Go Live!

April 23, 2020

First Payroll Deduction

Questions? We're here to answer them for you.

FAQs

We get it – health insurance isn’t exactly the easiest topic to navigate. We’ve got you covered!

Here are the answers to some of our most commonly asked questions:

What is League?

League is a digital app! You can make your benefits selections, get tools and resources to power your healthy lifestyle, and get live chat help if you need a hand with your health or benefits.

How do I earn points from Health Programs?

Your personalized Health Profile gives you a snapshot of your overall health and bonus League points. Complete the recommended Health Programs and hit your health and well-being goals, all while continuing to earn points. Redeem your points for Leaegue credit that you can use in the Marketplace.

When can I change my plan elections outside of this enrollment time period?

The only time you can change your health insurance coverage is when you experience a Qualifying Life Event like getting married or adding a mini-me to your family!

What is a Health Spending Account?

A Health Spending Account is a benefit through League that provides reimbursement for a wide range of health-related expenses, over and above regular benefit plans. HSA’s are administered in accordance with Canada Revenue Agency guidelines. Money spent from this account is tax-exempt (outside of Quebec)!

What is a Lifestyle Spending Account?

Lifestyle Spending Accounts (LSA) cover services and products you can access to live a healthier life, such as gym memberships, yoga and meditation, etc. Money spent from this account is a taxable benefit. You’ll only get taxed on the funds you actually use. League is the administrator of your LSA (instead of Desjardins) meaning that all claims are submitted directly through your League app.

What are the coverage differences for each plan and why do they have different costs?

At this time, there are two different plans under one carrier which all have different costs associated with them. As we continue with alignment / integration, you can expect to see these plans and costs streamline.

How much do I pay for these plans and how much is covered by my company?

Cost is dependent upon your plan selection at enrollment / re-enrollment time. Enhanced coverage for a family costs more than a single individual with core coverage, as an example. The costs are reflective of the plan you choose and those covered. You will see the associated costs in the enrollment / re-enrollment process as you select your coverage for yourself and dependents.

When can I see my payroll deductions?

You can see all the payroll deductions while in the enrollment experience making your elections. Once you’ve submitted your elections, you’ll be able to see all your payroll deductions based on the elections you’ve made.

I still have outstanding HSA claims to submit. Should I submit them to Desjardins?

Please submit any outstanding HSA claims to Desjardins at least a week prior to March 9th, 2020 for it to be processed by Desjardins. Any HSA claims incurred after April 1, 2020 can be submitted via the member wallet in League.

What happens if I don’t enroll?

If you are a new employee and do not make your benefit plan selections during your open enrollment period, you will be defaulted to the Core plan with Single coverage. If you are an existing employee and have participated in enrolments before, you will be defaulted to your current benefits coverage, if you do not update your selections during this open enrollment period.

Learn more about League

Tell us a bit about yourself and your company. We’ll follow up with you as soon as we get your info.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.